陈凯博客: www.kaichenblog.blogspot.com

陈凯博客: www.kaichenblog.blogspot.com陈凯一语:

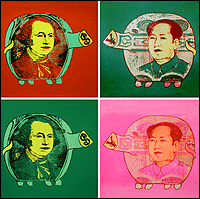

中共党朝的经济成长是与人的自由、尊严的获取成反比的。 一个得巨人症的人并不是正常人。 他的必然早卒是因为他的内在的成长(心肺、内脏)是与外在的催生成反比的。 中共党奴朝的崩溃之日就在眼前。

Kai Chen's Words:

China's Party-Dynasty's economy's fast growth can never be sustained due to a total lack of freedom/human dignity in the Chinese society. It is the same that a person with giangantism usually dies young, for his outside tissue growth can never be sustained by a deficient/deteriorating cardiovascular system. We can safely predict that China's Party-Dynasty's days are numbered.

"全球性的经济实力并不取决于GDP成长率、通膨率或任何货币币值。 一个全球性的经济体的影响力更在于一个国度/社会的人们及领导者们的道德品质。... 经济力与GDP的增长实际在于自由与社会信任度的增长。 人们的创造力与智商水准只有在自由的社会环境中在能充分得到发挥与提升。" --- 拉提夫

'Global economic greatness' does not come on the back of growth rate, or inflation rate or strength of any currency alone. Global dominance as a 'world economic power house' comes with factors that are determined by social, liberal, secular, tolerant practices and character of the leaders of the nation and its people. ... Economic strength and GDP growth is also sum total of freedom and trust. IQ's of people who are freed from chains of oppression are far greater and better.

--- Iqbal Latif

---------------------------------------------------------

Party-Dynasty's Economy vs. Freedom

中共党朝经济成长 vs. 自由与尊严

"The Economist" does it again… Will China overtake America to grab the number one spot as the world's biggest economy?

News Type: Event — Mon Dec 27, 2010 8:54 AM EST

By iqbal.latif http://iqballatif.newsvine.com/

The Economist: CHINA jumped ahead of Japan in 2010 to become the world's second-biggest economy, but when will it grab the number-one slot? The Economist's interactive chart allows you to make your own predictions. The relative paths of GDP in dollar terms in China and America depend not only on real growth rates but also on inflation and the yuan's exchange rate against the dollar. Over the past decade real GDP growth averaged 10.5% a year in China and 1.7% in America; inflation averaged 3.8% and 2.2% respectively.

Chinese communist party rule is the biggest impediment to maintaining this growth rate and economic supremacy over the world. If they cannot even allow someone to come out and collect his 'Nobel Peace prize' (Liu Xiaobo) and convict such an undisruptive person to solitary confinement, such a nation has only one certain prospect – that of a 'social implosion' like the USSR. It is only a matter of time.

Chinese 800-plus million standards of living and benchmark of freedom of expression do not in any way compare to most of the developed world, neither are they free to expand their families (a basic right of human beings) or move freely within the nation. These are important elements for a judicious and across-the-board economic growth. Harnessing the entire nation with the draconian law of 'one child only' is quite backward and will result in skewed demographics.

The Economist's model predicting Chinese economic supremacy is also suspect because it entirely overlooks the fact that all three factors embracing the model depend on global/USA ability to continue to buy huge Chinese imports. If the world trade collapses, indigenous Chinese demand alone cannot sustain the monumental 7.5% growth rate without triggering massive hyperinflation.

'Global economic greatness' does not come on the back of growth rate, or inflation rate or strength of any currency alone. Global dominance as a 'world economic power house' comes with factors that are determined by social, liberal, secular, tolerant practices and character of the leaders of the nation and its people.

I would have expected from 'The Economist' to do better than developing these very low level of distorted gimmicks. These are the kind of projections that estimated that the most indebted nation today, Japan, should have taken over the world. Now The Economist is worried whether they will be liquid enough in fifty years to pay a huge aging and retiring population health bills. (I think the worry is misplaced, they will do well).

USA's future as a great nation is so far secure; the strength of $ is based on $ as a currency of trade for oil, gold and most of the commodities. When global turmoil hits the world, the US dollar remains as a peg and a safe haven. The defence spending to maintain global clout and ability of America to produce world class R&D alone ensures dominance of USA in this century.

Economic strength and GDP growth is also sum total of freedom and trust. IQ's of people who are freed from chains of oppression are far greater and better.

An interesting "analysis" on China's supremacy as a world economic power by The Economist inspired this counter argument.

-------------------------------------------------------------------------

From Economist Magazine:

"CHINA jumped ahead of Japan in 2010 to become the world’s second-biggest economy, but when will it grab the number-one slot? The Economist’s interactive chart allows you to make your own predictions. The relative paths of GDP in dollar terms in China and America depend not only on real growth rates but also on inflation and the yuan’s exchange rate against the dollar. Over the past decade real GDP growth averaged 10.5% a year in China and 1.7% in America; inflation averaged 3.8% and 2.2% respectively. Since Beijing scrapped its dollar peg in 2005, the yuan has risen by an annual average of 4.2%. Our best guess for the next decade is that annual real GDP growth averages 7.75% in China and 2.5% in America, inflation rates average 4% and 1.5%, and the yuan appreciates by 3% a year. Plug in these numbers and China will overtake America in 2019. But if China’s real growth rate slows to an annual average of only 5%, then (leaving the other assumptions unchanged) China would become number one in 2022. Please place your own bets."

Answer by Igbal Latif: This is possible when oil is at $5, like earlier Economist predictions (intended to be a tongue in cheek remark) and when 1 billion-plus Chinese have freedoms and civil rights exactly like the Americans do. Economic strength and GDP growth is also sum total of freedom and trust. IQ's of people who are freed from chains of oppression are far greater and better.

Chinese communist party rule is the biggest impediment to maintaining this growth rate and economic supremacy over the world. If they cannot even allow someone to come out and collect his 'Nobel Peace prize' (Liu Xiaobo) and convict such an undisruptive person to solitary confinement, such a nation has only one certain prospect – that of a 'social implosion’ like the USSR. It is only a matter of time.

The essential nature of such an evolution from despotic rule to benevolent rule will dictate the GDP growth rate for the next few decades.

'Global economic greatness' does not come on the back of growth rate, or inflation rate or strength of any currency alone. Global dominance as a 'world economic power house' comes with factors that are determined by social, liberal, secular, tolerant practices and character of the leaders of the nation and its people.

Clout of a great prospective nation should include, amongst others trust and freedom, within a nation. The 'strength' is not just judged by the 'reserves and GDP growth' (with growth from very low ''great leap forward experiments,'' standards of Chinese living should be higher); those are important things but the major issue is the living standards of the lowest segment of the society also.

Chinese 800-plus million standards of living and benchmark of freedom of expression do not in any way compare to most of the developed world, neither are they free to expand their families (a basic right of human beings) or move freely within the nation. These are important elements for a judicious and across-the-board economic growth. Harnessing the entire nation with the draconian law of ‘one child only’ is quite backward and will result in skewed demographics.

I would have expected from 'The Economist' to do better than developing these very low level of distorted gimmicks. These are the kind of projections that estimated that the most indebted nation today, Japan, should have taken over the world. Now The Economist is worried whether they will be liquid enough in fifty years to pay a huge aging and retiring population health bills. (I think the worry is misplaced, they will do well).

This model predicting Chinese economic supremacy is also suspect because it entirely overlooks the fact that all three factors embracing the model depend on global/USA ability to continue to buy huge Chinese imports. If the world trade collapses, indigenous Chinese demand alone cannot sustain the monumental 7.5% growth rate without triggering massive hyperinflation.

USA’s future as a great nation is so far secure; the strength of $ is based on $ as a currency of trade for oil, gold and most of the commodities. When global turmoil hits the world, the US dollar remains as a peg and a safe haven. The defence spending to maintain global clout and ability of America to produce world class R&D alone ensures dominance of USA in this century.

Yes, all the above can be wrong if China becomes free soon and ensures a non violent multiparty rule and 1.4 billion Chinese vote for policies that may help widespread freedom, egalitarianism and growth that is uniform (though freedom of a nation from yokes of totalitarianism unfortunately retards GDP progress of any nation). Revolutions and changes are big ticket items; reality check with France and USA will tell you that.

The big 'IF ' is if 'Chinese multiparty rule will emerge as a peaceful model without derailing Chinese disciplinarian economic mould, which is presently based on a firm central control of the communist party. If the transition is peaceful and 'Chinese compliant psyche and unified nationalist tendencies' cooperate in a peaceful manner to achieve this transformation from one party system to multiparty rule which obviously is quite a chaotic choice, we can then develop a model based on GDP growth, inflation rate and strength of currency that is so modestly and banally presented here.

My advice to 'The Economist': It is 'Freedom, silly' that makes a nation great all around! Incentive and rewards are now part of the Chinese economic structure but freedom of expression is not; this dichotomy points to the difficult road ahead that Chinese communist party will have to negotiate very carefully. With wealth comes dissent and urge of influence, the conglomerates and powerful oligarchs will have their own impetus to articulate the directions of a future the way everyone wants.

No comments:

Post a Comment