陈凯访谈/腐败文化、制度导致腐败变态体育

Corrupt Culture/Political System Leads to Perverse Sports

【赌球_中国禁闻_中国新闻评论】中国足协因赌球开罚单 打假扫黑落幕了?

---------------------------------------------------------------------------------------------------------

The Chinese Conscience is Actually a Moral Corruption

中国人的“选择性良知”其实是一个道德堕落与败坏

Kai Chen/Just a Thought

陈凯/一思

根据安全与否(权势者、传统与多数是否接受)而决定是否表达一个人的良知其实是一个人怯懦、混乱与腐败的表现。

3/11/2013

The recent anger and uproar over the murder of an infant in Changchun "car thief confession" and the past seemingly display of the "Chinese Conscience" over "Little Yueyue's accidental death" all show me only one thing: The "zombie state" of immorality in China is beyond repair and salvage. Indeed, China needs not to be saved but to be destroyed entirely and start anew.

I am not talking about the criminals and culprits in the incidents. I am talking about how/when/where the Chinese choose to react to show their indignation toward these incidents. Choosing carefully to display one's anger according NOT to one's own conscience and sense of justice, but ONLY to how safe and how convenient the circumstances are is truly "a morality and conscience with Chinese characteristics".

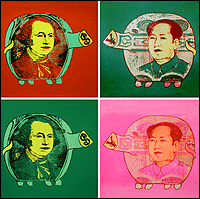

With millions having been murdered by Mao and the communist regime in China, with millions of forced abortions and infanticides, with injustice and atrocities committed by the current Chinese regime every minute in one's own neighborhood, with the biggest mass murderer in human history - Mao's images everywhere and on Tiananmen Square, the Chinese choose to remain silent. While in the case of Changchu "car thief murder" and Little Yueyue cases, suddenly there is an uproar among the Chinese as if they finally have found their inner conscience and a sense of justice. Yet in truth/fact/reality, this seeming indignation over the murder of an infant only shows the Chinese cowardice, moral decay and a state of zombie-like existence.

Choosing when to show one's anger and indignation according to circumstances and safety is a manifestation of "moral relativism" widely adopted and displayed by the leftists in the West/America. In China's case, this expedient "morality" has always been the "Confucian ethics of hierarchy" since the beginning of China's existence. It has been the MO of the Chinese immoral/amoral/anti-moral display throughout its few thousand of years of history. Some people compare the incidents with the similar cases in the West and America. But a stark contrast is the reality. In China, people has always been told by the government what is good or bad - good is bad and bad is good based upon whether or not one's behavior benefit/damage the collective. They have long castrated themselves of the sense of morality instilled in them only by God. In the West/America, the moral compass has always been in place to guide/direct the society (due to the presence of a Judeo-Christian culture) - good is good and bad is bad regardless of the circumstances/collective interests.

This stark contrast in one's moral behavior results in Western societies moving forward while the Chinese society revolves around a deadly and nihilistic dynastic cycle. In Chinese zombies' eyes, there is no direction or guidance by a divine entity. There is only a moment to moment existence guided by one's instinct of survival and a culture of moral expediency: You shut up when danger is present. You shout out when government permits you to voice. The bad is never bad and viewed as wisdom even virtue if one can survive physically. Guns and murderers become gods in China. Mao's image being everywhere is not surprisingly the necessary result.

Indeed, in the West/America, people worship Christ who was murdered by the multitude of morally confused, while in China people (the multitude of morally confused and castrated) worship Mao who murdered tens of millions. Do you still see the eunuchs and zombies in China as moral beings, as displayed by Changchu "car thief murder" and Little Yueyue?

I rest my case.

------------------------------------------------------------------------------------------

IS CHINA’S ECONOMY GETTING SNAKE BIT?

安一鸣/蛇年评中国经济“被蛇咬”

By Greg Authy (Author of "Death by China")

China’s central bank withdrew an all-time weekly record high of $145 billion from their banking system this week. China often increases liquidity in early February prior to their Chinese New Year and then decreases liquidity after the holiday. But the extent of the reduction dwarfed the $106 billion added this New Year. The People’s Bank of China has now drained a net $87 billion from the banking system since December 31st, compared with a net injection of $230 billion last year. Economists refer to this activity as “Taking the punch bowl away just when the party is getting good.” What this generally indicates is the Chinese government is being forced to strangle new lending because inflation is exploding. Given that the United States is on the verge of a recession, it appears this Year of the Snake may be about to bite China’s economy.

Outgoing Chinese Premier Wen Jiabao called for local governments to impose restrictions to “decisively” curb housing market speculation. He described house appreciation as “excessively fast” and ordered municipalities to publish annual price control targets. Concern of the Chinese federal government include:

- Local governments are turning to property sales to boost their revenue. As the majority land owner, local governments are incentivized to sell property at inflated prices to developers financed by state owned banks.

- China’s total credit is now a speculative 190% of the entire economy.

- Andy Xie of Morgan Stanley points out that at the end of 2012, there were 95.4 billion square feet of property under construction, half residential and the rest office/commercial. This equates to 1.5 times the entire China GDP.

Mainstream economists assume the Chinese government’s actions are “prudent” to continue their high economic growth. But China’s economic statistics are not credible. The nation reported that January exports were up 25% over last year. But China’s biggest trading partner, Europe, is in shambles. If China had huge growth, it did not come from exports.

What did happen in China is total “social lending”, the broadest measure of economic liquidity, increased in January to $399 billion from $260 billion in December. I believe the “recovery” is being driven by local government pushing real estate speculation.

China appears to be repeating the same strategy they followed during the 2008 to 2010 financial crisis. The country implemented a spectacular $640 billion stimulus package to ward off an economic slump when their export markets in the developed economies imploded. With China’s deficit-spending stimulus focused on massive infrastructure and property-related capital investments, the economy stabilized, but real estate prices exploded. When property prices leveled off in 2011, bad debts at banks skyrocketed.

Premier Wen Jiabao has stated funding this activity had been a mistake, but China’s leadership allowed it to happen again after the economy slowed in the 2nd quarter of last year. The central government officially unveiled another $160 billion infrastructure package in September, but unofficially local governments launched a similar package estimated to total up to $2.1 trillion. Total credit for January showed a sharp increase from the first half of last year. For 2012, credit financing grew 20%, trust loans were up 80%, foreign exchange loans up 27% and other financing increased by 45%.

The unbalanced Chinese export-driven economy was fragile before 2012. Now according to hedge fund mega-short expert, Jim Chanos: “They’re on a treadmill to hell. Either they try to keep blowing the bubble to maintain economic growth or they risk an immediate economic crash.”

China may have a savings rate of 53% of GDP, and $3.3 trillion in foreign exchange reserves, but the majority of these reserves are tied up in U.S. government bonds. If China sells 10% of these bonds to bail out their own economy, U.S. interest rates will spike and the U.S. economy would tank. Such an event would cause a worldwide recession and hammer China’s exports.

China’s export-reliant economy is based on expanding worldwide trade. In Chinese “symbology”, snakes are regarded as intelligent, but with a tendency to be somewhat unscrupulous. With the United States already on the verge recession, China’s economy may get bit in the Year of the Snake.

No comments:

Post a Comment